- 📋 What is a TFN?

- When do I have to apply for a TFN?

- Are there any costs involved when applying for a Tax File Number?

- 📖 TFN Application: How to apply and get the TFN (Tax File Number)

- 1. Go to the Australian Taxation Office website, and click on the option "Foreign Passport Holders".

- 2. If you meet all three requirements:

- 3. Then, just click on START:

- 4. You must complete five sections and then wait for processing:

- ⏰ How long will the TFN take to arrive?

- 🗓️ How long does the TFN last?

- 🧑💼 Can I start working if I have not yet registered my TFN?

- What is an ABN?

- What is the difference between ABN and TFN?

- Tax Rates 2022 - 2023

You have just arrived in the country with your Working Holiday Australia, you have visited the centre of Sydney, you were surprised by the Opera House, you went for a drink at The Rocks, but, after one or two days, you are going to have to start with some formalities.

You can visit our guide on "Your first week in Australia", to see our recommendations and tips on what not to miss when you arrive in Australia. One of the most important things you will need to do is to get your TFN (Tax File Number).

📋 What is a TFN?

It’s your Tax File Number. It is a 9-digit number issued by the Australian Taxation Office (ATO). The Tax File Number is the tax deduction and retirement identification number. In short, it is a number you need to do your job and through which the government can identify you for tax purposes if you want to extend your visa or claim tax deductions. Here's how to prepare a tax return in Australia.

Just so you know, you can work without applying, but if you have a Working Holiday visa, you will have around 45% of your salary deducted as tax!

The TFN is unique to each person. If you change your address, phone number, place of work, you don't have to declare anything as you will always have the same TFN number.

This number is MANDATORY in order to work in Australia. It will be systematically requested by your Australian employers.

The TFN application must be made upon arrival in Australia via the ATO website. This procedure is done online and is completely free. You will only need your passport number.

Once you have completed your online application, you will receive your TFN by post within 28 days of your application.

Your employer will then deduct tax from your income under the Pay As You Go or PAYG system. Since tax is deducted at source by your employer, generally you won’t have to worry about your tax liability at the end of the year.

When do I have to apply for a TFN?

The TFN must be processed once you have arrived in Australia, as it cannot be done outside the country.

Are there any costs involved when applying for a Tax File Number?

The TFN Number is totally FREE!

📖 TFN Application: How to apply and get the TFN (Tax File Number)

The TFN application is made ONLINE through the ATO (Australian Taxation Office) website. You have to complete the online application form of ATO TFN declaration form to obtain the TFN and wait for it to arrive by mail or post.

Prior to getting your TFN (Tax File Number), there are certain requirements that must be met:

- 📱 Having an Australian phone number.

- 🏦 Having an Australian bank account under your name.

To open one, just go to any bank branch with your passport, a copy of your visa, your Australian address and your mobile phone number.

Then, completing the online form is pretty simple, however, here is a step by step guide on how to complete it:

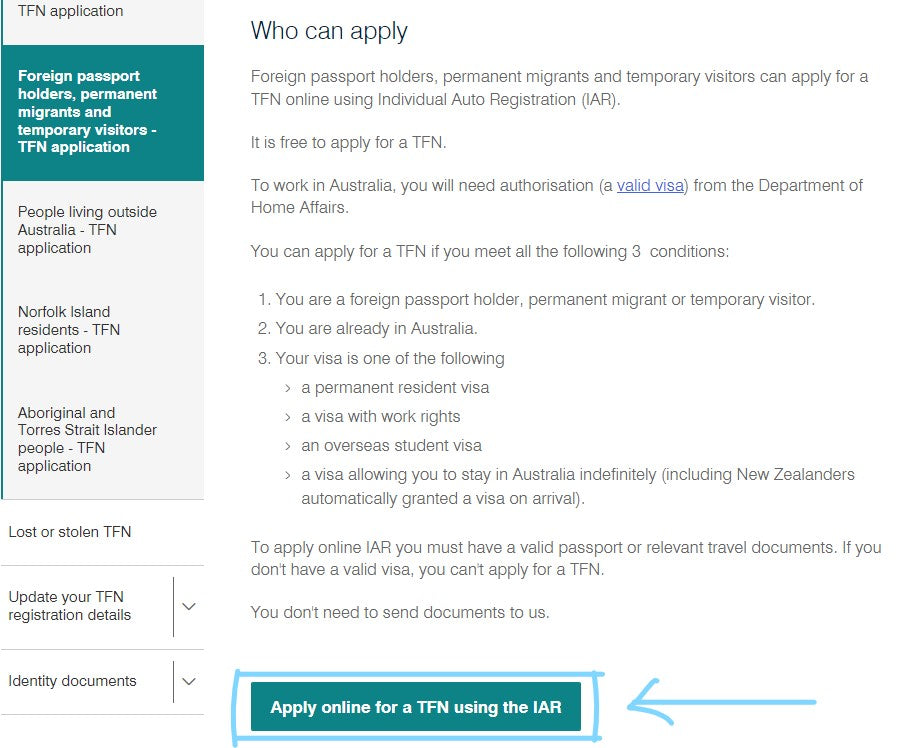

1. Go to the Australian Taxation Office website, and click on the option "Foreign Passport Holders".

2. If you meet all three requirements:

- You hold a foreign passport, are a permanent migrant or temporary visitor.

- You are in Australia.

- You have a Student Visa or a visa with work rights

Just click on the button "Apply online for a TFN using the IAR" and start the process!

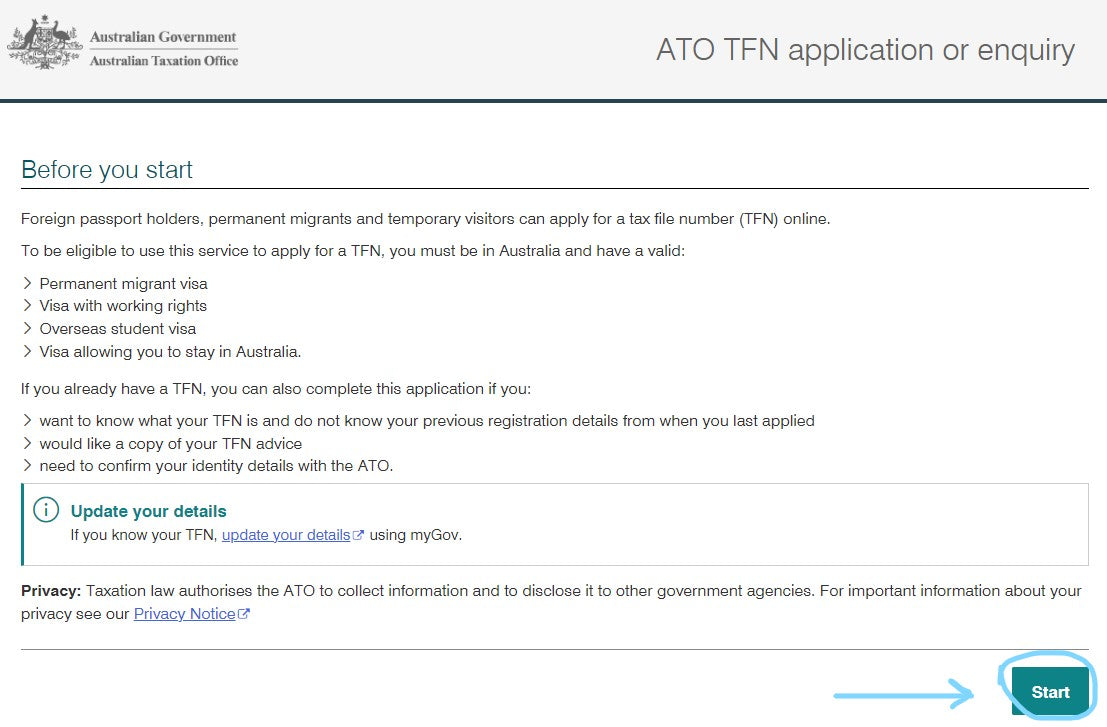

3. Then, just click on START:

In this step you are given a more detailed explanation of the process: It will take on average 20 minutes and you will be asked for a series of personal details to verify that you can access a TFN, and also to generate it.

4. You must complete five sections and then wait for processing:

- Travel document details: 3 simple questions; passport number, nationality and whether you have been to Australia before.

- Personal details: in this category you only have to provide your personal details. Make sure they match with the information on your passport.

- Existing TFN, ABN or CRN information: basically they ask if you have had these tax numbers before.

- Address details: fill in here the address of your accommodation, whether it is a hostel, a flat, etc. If your address changes, you must report the change by calling 13 28 61.

- Review that the information you provided is accurate.

5. Once you have finished filling in the form, the ATO platform will give you the Application Reference Number (it has 13 digits).

You can use this number to track the approval process of your TFN, and you can also use it to make any claims in case it does not arrive at your home after 28 days.

Furthermore, it will be useful to show your future employer that you can start working, as your Tax File Number is in process.

⏰ How long will the TFN take to arrive?

According to the ATO, the maximum time to get your TFN is 28 days. There were travellers who received it in less time and others who received it just after 28 days.

There have been other cases where they received it by mail and by post, some only by mail and others who had to call to get it.

If you have not received it in time or satisfactorily, you can call 13 28 28 61 from Australia from Monday to Friday from 9am to 6pm.

🗓️ How long does the TFN last?

The Tax File Number is valid for life and you keep the same TFN even if you change your name, job or move. Once you process it you do not need to do it again whether you leave the country and then return at another time.

🧑💼 Can I start working if I have not yet registered my TFN?

Yes, you can start working without a TFN. For most jobs, employers can wait up to a month, but I advise you to do it as soon as you arrive in Sydney or wherever you are going.

Remember that some people have got it in a few days, but there are others who waited all 28 days, so don't delay in getting it and do it as soon as you arrive in Australia.

What is an ABN?

It’s your Australian Business Number. This number is needed in addition to the TFN for people who want to be self-employed (auto-entrepreneurs).

Every business operating in Australia must have an ABN (ABN). Even if you’re self-employed or operating as a sole trader, you must also have one. In this case, you’ll include your ABN when invoicing clients and customers for work you have performed.

Some common examples of occupations that likely require an ABN are; carpentry, graphic design, consultancy services, personal training etc.

As with the TFN, applying for an ABN is done online and is completely free.

What is the difference between ABN and TFN?

- The TFN is essential for all individuals when filing their annual tax return. With the TFN number you are usually an employee of the business.

- ABN stands for Australian Business Number and is essential for starting a business. With the ABN number you are usually hired as a contractor.

Tax Rates 2022 - 2023

You are considered a tax resident as soon as you have your main residence or if you live in the country for more than 6 months a year at the same address.

|

Taxable income |

Tax on this income |

|

0$ – 18,000 |

Nil |

|

$18,201 – $45,000 |

19c for each $1 over $18,200 |

|

$45,001 – $120,000 |

$5,092 plus 32.5c for each $1 over $45,000 |

|

$120,001 – $180,000 |

$29,467 plus 37c for each $1 over $120,000 |

|

$180,001 and over |

$51,667 plus 45c for each $1 over $180,000 |

Based on your visa, the Australian government believes that you do not intend to stay in Australia. Your wage will then be taxed more compared to a tax resident. Since January 2017 Visas 417 and 462 are taxed 15% for the first $45,000 of their income. Over this amount, they are taxed 32.5% as any Australian.

|

Taxable income |

Tax on this income |

|

0 – $45,000 |

15% |

|

$45,001 – $120,000 |

$6,750 plus 32.5 cents for each $1 over $45,000 |

|

$120,001 – $180,000 |

$31,125 plus 37 cents for each $1 over $120,000 |

|

$180,001 and over |

$53,325 plus 45 cents for each $1 over $180,000 |

How can I find my Tax File Number?

If you have lost or forgotten your TFN, there are several ways to recover it:

- Check your documents: Look for any tax-related documents you may have, such as a tax return or notice of assessment, as your TFN should be included in those documents.

- Check your payslip: Your TFN should be on your payslip if you have provided it to your employer.

- Contact your employer: Your employer should have a record of your TFN if they provided it to you when you started work.

- Contact the ATO: If you still cannot find your TFN, you can contact the ATO on 13 28 61 and give them some personal information to verify your identity. They may be able to provide you with your TFN over the phone or mail it to your registered address.

Please note that it is important that you keep your TFN in a safe place and that you only give it to trusted entities, such as your company or the ATO.